OK thanks to the American Rescue Plan Act of 2021 (ARPA) and last year's Coronavirus Aid, Relief and Economic Security Act of 2020 (CARES Act), we have a lot of income that may or may not impact your healthcare. If you have a good tax preparer do not hesitate to talk with them if you have questions. As this is only some of the simple guidelines.

Here is the FAQ from the Healthplanfinder about the American Rescue Plan. It is a big deal and we have talked several times about the impact that is having on healthcare for good. Here we talked about it on our Podcast: Suzilla.

|

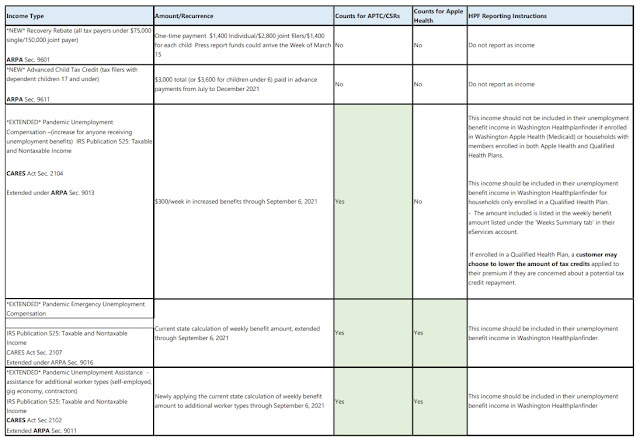

| Tax guideline chart |

On the Washington Healthplanfinder, there are two types of plans.

1. The Qualified Health Plans which can use Advanced Premium Tax Credits (APTC) to lower monthly costs. If the Income level is under 250% of poverty level then a household can also receive Cost Sharing Reduction (CSR) which lowers things like deductibles, out of pocket maximums and co-pays to increase household savings.

2. Apple Health which is our state's Medicaid Program.

Anytime that your income changes by $150 by two months in a row then you want to update your income to the Washington Healthplanfinder as it can impact the cost of health insurance. The simple chart has income that you may be receiving that you need to account for on the Washington Healthplanfinder for in green. If you are one of our clients then let us know and we can make the adjustments for you.

If you are receiving the income then you may wish to reduce your tax credits. While you are spending more on a monthly basis for healthcare, it could reduce any payback of tax credits when you file your taxes the following year.

|

| There are silver plans for zero cost for the 1st time. |

Tax Credit adjustments are forecast to be applied by the Washington Healthplanfinder by the middle of May. This means that most people will have lower cost health insurance. If you want a sneak peak of the amount then here is a price calculator.

The prices will impact for 2021 and 2022. If you do not have Health Insurance then you have until May 15th. We can assist in Washington state. We are a Full Service Enrollment Center with the Washington Healthplanfinder.

Comments

Post a Comment